The Natural Products Expo West show floor was jam-packed with the latest product innovations, setting the stage for the future of natural food and beverage brands. Check out our recap of the most memorable trends and standout products!

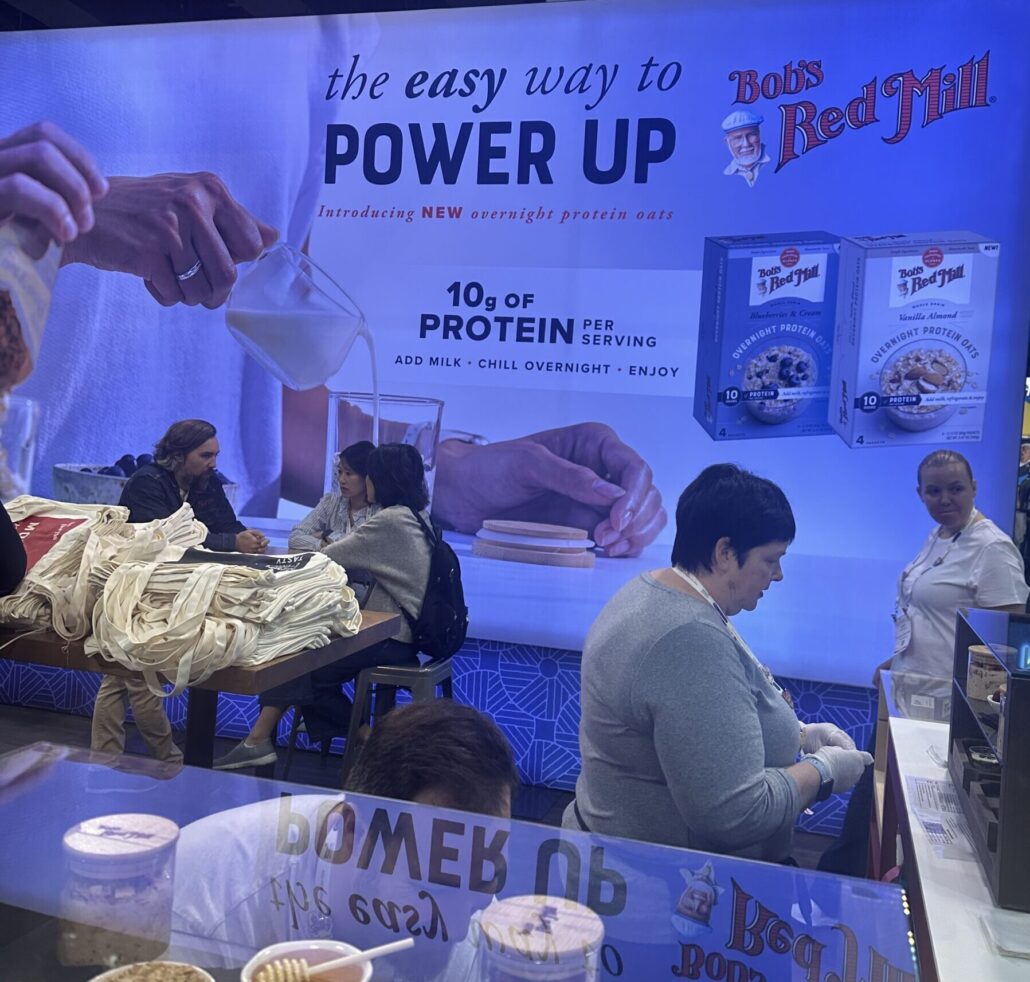

Expo West 2025 made one thing clear: Breakfast is getting a glow-up. Whether you’re a “grab-and-go” type or a “sit down and savor” kind of person, brands like Birch Benders, Brazi Bites and Bob’s Red Mill are reshaping how we start the day.

Forget cereal brands of the past—breakfast is a booming platform for functional, nutrient-rich ingredients. Think reduced sugar, protein-packed options to kickstart the day with purpose. Morning meals are now designed to be indulgent, yet mindful, showing that better breakfast habits can be deliciously enticing.

Birch Benders: Pancake mixes including keto-friendly and high protein options with unique flavor twists like Ube Mochi

Brazi Bites: Gluten-free, crispy and fluffy blueberry waffles with 5 grams of protein and “simple wholesome ingredients”

Bob’s Red Mill: NEW Overnight oats with 10 grams of protein, available in blueberries & cream and vanilla almond flavors

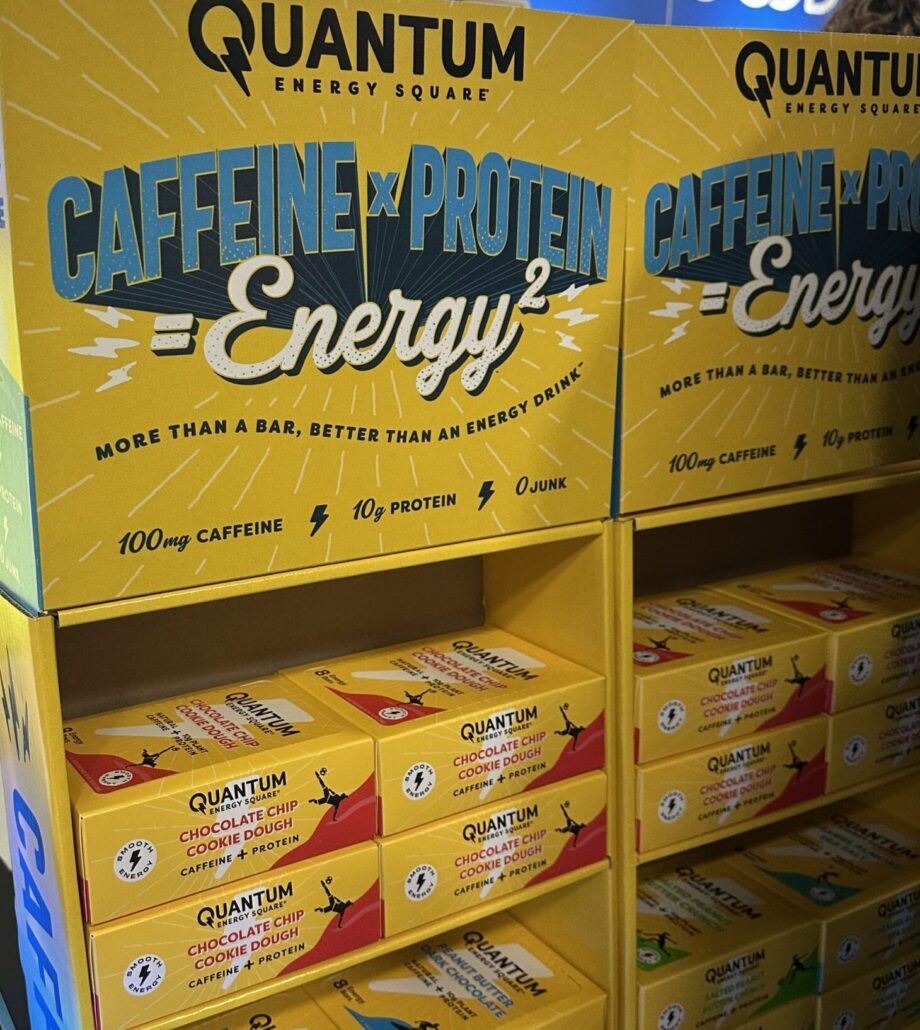

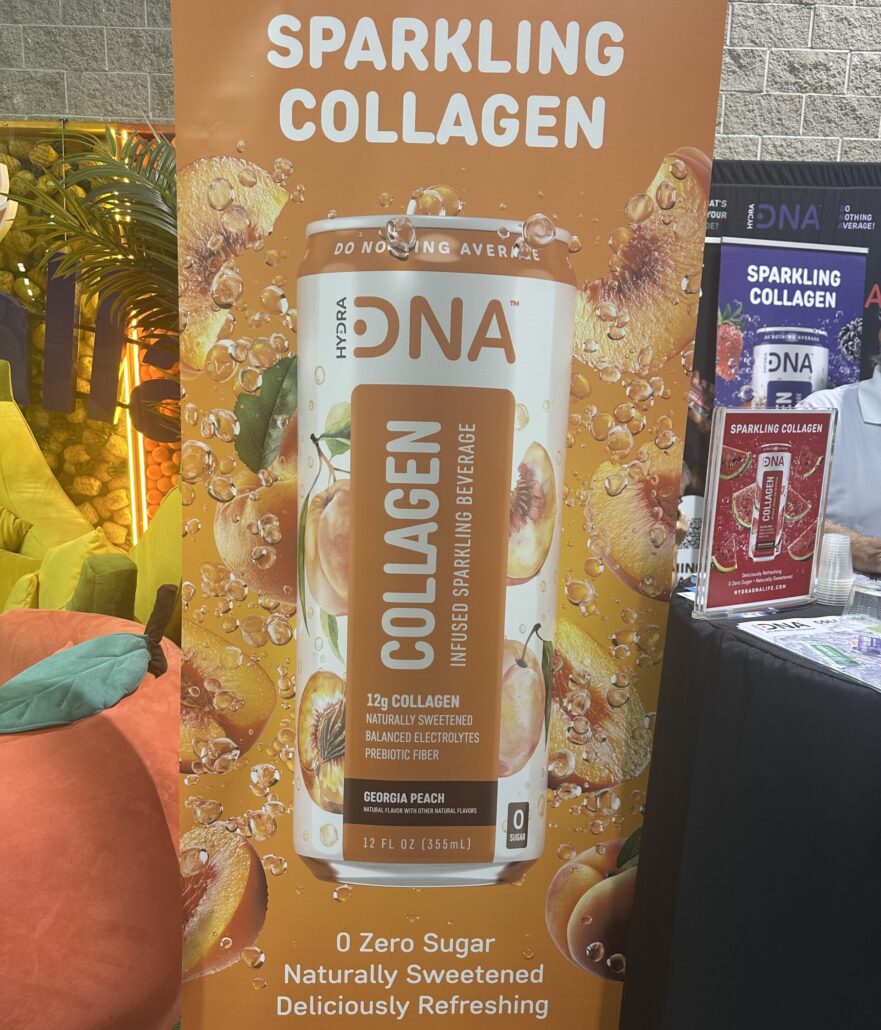

Why choose one benefit when you can have multiple? Brands throughout the halls showcased products that combine functional ingredients to simplify wellness.

From Quantum’s Caffeine + Protein bars to Pirq’s Plant Protein blended with probiotics, these innovations are all about benefit-stacking. Gut health, immunity, energy—why not tackle them all in one sip or bite? For busy lifestyles, this multifunctional approach makes meeting nutritional needs more manageable.

Quantum Squares: Energy x Protein variety combining 100mg of natural caffeine and 10 grams of plant protein

HyrdaDNA: A benefits-packed beverage featuring 13 grams of collagen, electrolytes and prebiotics with zero sugar

Pirq: Plant protein + probiotics and superfoods, including curcumin and maca

Gut health is no longer just a buzzword—it’s a movement, and brands are innovating to meet the needs of those seeking functionality and comfort.

Prebiotics and probiotics are stealing the spotlight, with bars, beverages and granolas infused with gut-friendly ingredients. And for sensitive stomachs? Low-FODMAP snacks from ensure everyone can join the gut health party.

Brands are also combining the best of both worlds with synbiotic products that deliver prebiotics and probiotics together, giving consumers a simple way to amplify their wellness routines.

Bear’s Fruit: Probiotic sparkling water designed to support digestion and immunity, with bold flavors like Mango Habanero and Blackberry Sage

Blume: SuperBelly Gut-Building Hydration Powder blends prebiotics and probiotics to support digestive health while providing hydration

Fody: FODMAP– friendly bars, sauces and pantry staples suitable for consumers with IBS and sensitive digestive systems

There is a growing wave of products focused on metabolic health, catering to consumers who are prioritizing weight management and balanced blood sugar. With the increasing interest around GLP-1 receptor agonists and their role in appetite control, brands are stepping up with functional solutions that align with these needs while promoting a holistic approach to wellness.

Products with prebiotic fibers and protein are designed to keep consumers feeling fuller longer, reduce cravings, and promote mindful eating. Protein remains a dominant ingredient for metabolic health, with clean label sources like whey and pea proteins supporting muscle maintenance. Fiber, however, is gaining traction as a close contender.

Perfy: A functional and caffeine-free soda that claims to “boost mood, not blood sugar” through ingredients like l-theanine, adaptogens and turmeric without added sugar

Nature’s Answer: Plant Head GLP-1 Support is a supplement designed to complement GLP-1 therapy by addressing common challenges like muscle loss, digestive discomfort and nutrient deficiencies

Good Idea: A lightly sparkling water featuring amino acids and chromium picolinate to “prime your metabolism”

The spotlight on energy and mood support revealed a shift away from a quick jolt, instead focusing on sustained, balanced energy and overall mood and well-being.

Beverages are now powered by natural energy sources, adaptogens, nootropics and other ingredients designed to offer a more controlled boost. This approach taps into consumer interest in focus, calm, and mood management, signaling a new era of functional energy drinks.

Mind Garden: Sparkling elixirs made with brewed hemp, fruit juice and infused with adaptogens and nootropics known to relax the mind and sharpen focus

Odyssey: This sparkling beverage is said to be energy and focus-boosting, containing Lion’s Mane, Cordyceps and 222 mg of caffeine. The 222 leans on a numerology link as “222” is said to vibrate with optimism, hope, fortune, and joy

Melting Forest: The energy line contains 150 mg of caffeine per serving from green coffee beans alongside mushrooms for sustained energy and focus

Other Picks From the Team

New Primal Snack Mates Chicken & Maple Mini Sticks were a team favorite, offering a convenient, high-protein snack with a perfect balance of sweet and savory flavors that were both satisfying and delicious.

Chocxo Passion Fruit Chocolate Cups were the perfect post-lunch treat. Their bright, tangy passion fruit flavor paired with just 5 grams of sugar made for a perfect bite.

Painterland Sisters Vanilla Bean Skyr Yogurt combines a rich, creamy texture with the perfect vanilla bean flavor, offering 16 grams of protein and probiotics—showing that healthy can truly feel indulgent.

See you all back in Anaheim next year!

700 Collip Circle, Suite 209 London, ON N6G 4X8

1051 Perimeter Drive, Suite 1150 Schaumburg, IL 60173