TOP 3 BREAKOUT BIOTIC OPPORTUNITIES TO WIN IN 2025

Bonus Year in Review: Realization of 2024 Gut Health Product Predictions

Insight: December 2024

Share:

Consumer interest in biotics products is soaring, with 76% of consumers recognizing the link between good gut health and overall wellnessi, further solidifying that this functional food movement is here to stay. COMET’s trend spotters have mined the data to identify new wellness growth opportunities for food, beverage, and supplement manufacturers in the year ahead.

Read on for COMET’s TOP 3 BREAKOUT opportunities where the industry can meet consumers where they are actively searching for biotics products. Also, check out how COMET’s 2024 PREDICTIONS landed with category movement and new product launches.

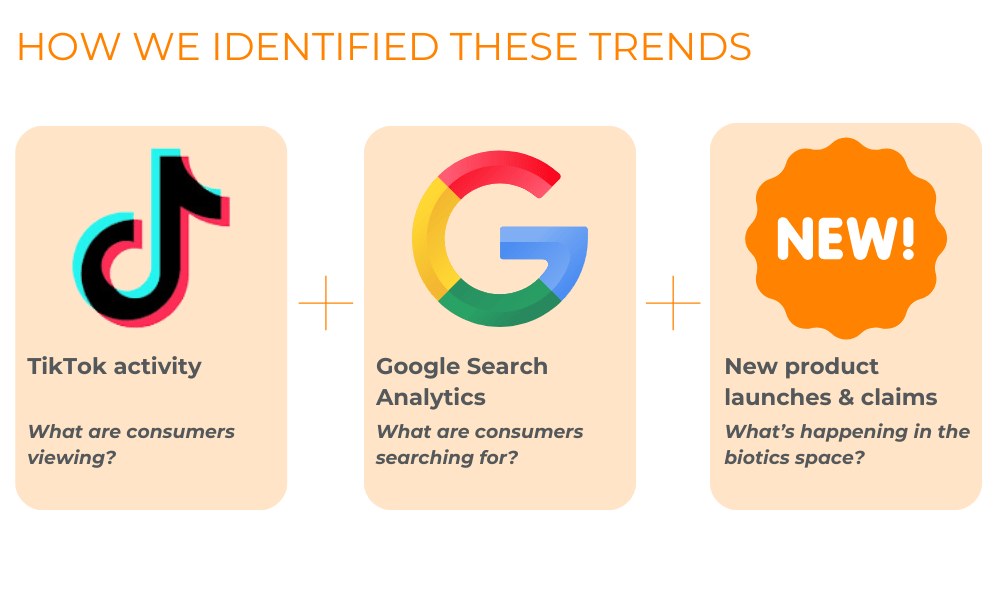

See how we collected and analyzed data using TikTok trends, social listening, product claims and Google search data in our methodology section.

TREND #1: GUT MICROBIOME BENEFITS BEYOND DIGESTIVE HEALTH

WHAT YOU CAN EXPECT: Consumer searches show that gut health is driving conversation in the wellness space and demand is rising for biotic benefits beyond the gut including metabolic health, women’s health, immune health and cognition & mood.

Biotics Product Claim Growth

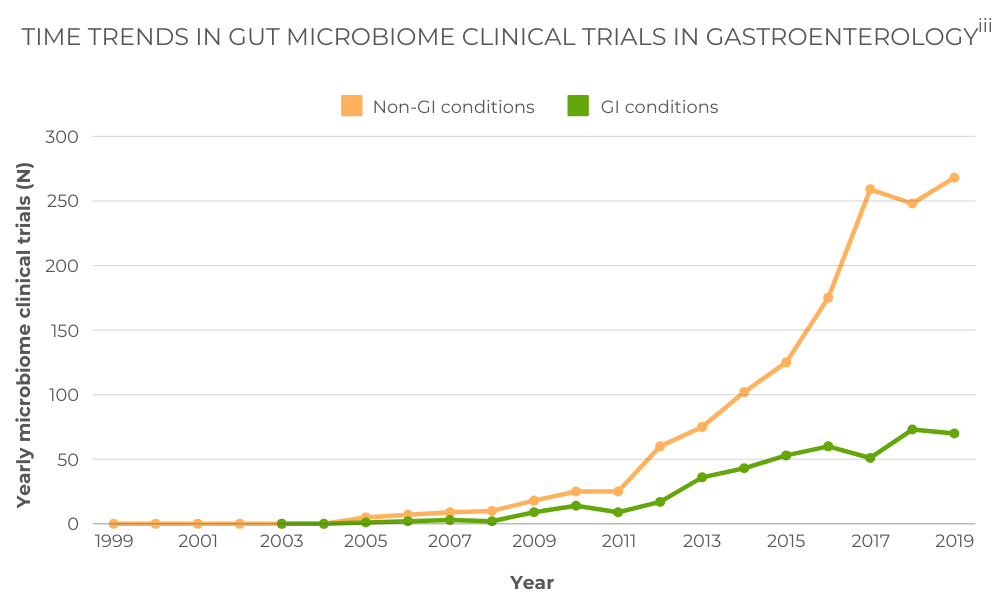

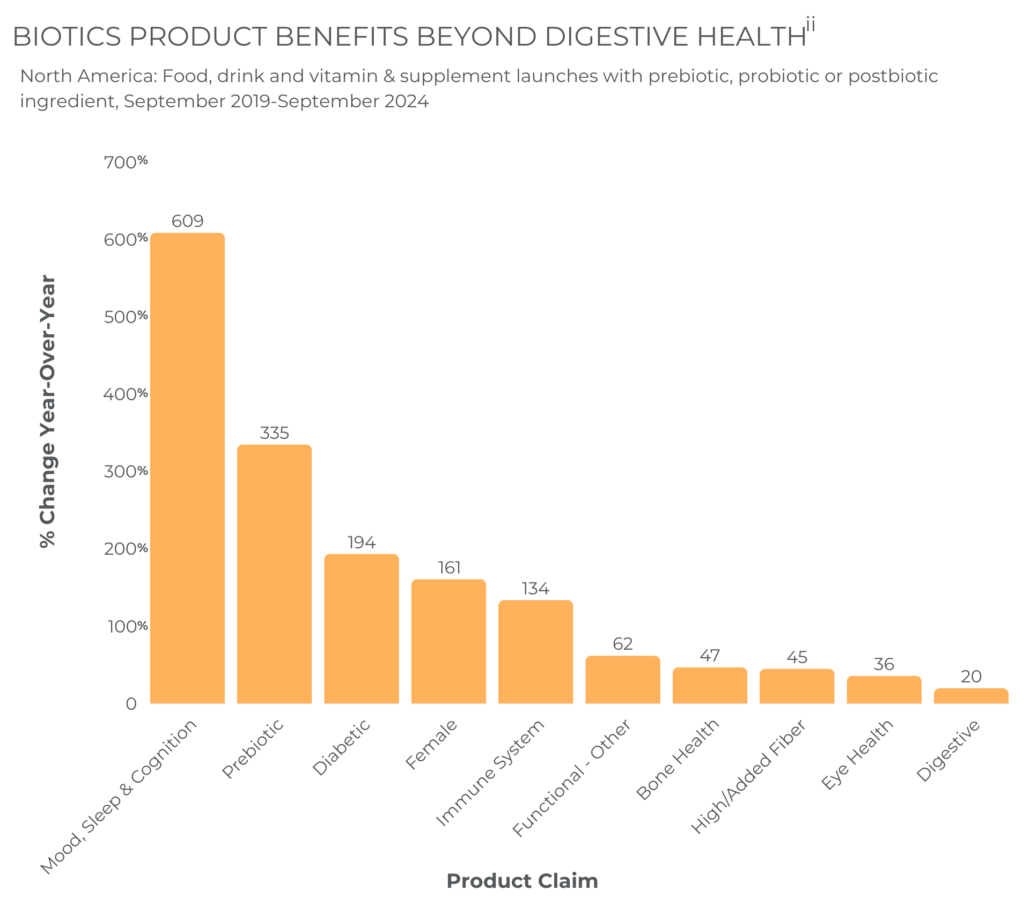

According to Mintel’s Global New Product Database, the “digestive” product claim continues to have its moment with new product launches containing biotics ingredients growing 20% annuallyii (see below). Meanwhile, in recent years, gut microbiome clinical trials have focused on benefits beyond digestive health. Notably, one review of clinical trials on file with the National Institutes of Health in 2020 revealed that of 2,048 microbiome clinical trials, only 24% investigated gastrointestinal diseases and conditions, while 76% were non-GI conditionsiii (see right).

Let’s dig into several of these claims that are making the biggest waves.

1. Metabolic Health

According to Mintel GNPD data, there has been a 194% increase in diabetes-related product claims made on new products containing pre, pro or postbiotics over the last five years. Many of these include dietary fiber to boost satiety, increase satisfaction, help to reduce appetite and cut down overall calorie intake. Food Navigator takes this a step further to suggest that manufacturers in the gut health space could target people who struggle with food addiction.iv

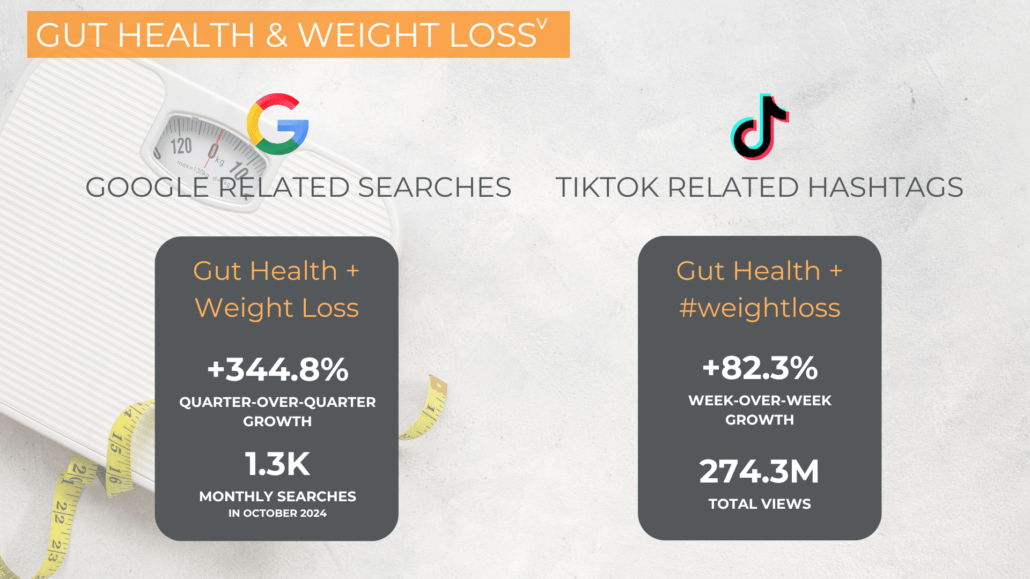

Building on COMET’s 2024 Ozempic Alternative trend prediction (see: COMET’s 2024 Trend Predictions), we see a growing awareness of the connection between gut health and weight management. Consumers are realizing that biotics and prebiotic dietary fiber may support weight management and metabolism in ways like the popular Semaglutide (GLP-1) drugs like Ozempic.

Google searches for “gut health and weight” are up 25.5% in 2024 over the same time in 2023, and Spate’s social listening tool analysis of TikTok data shows a staggering almost 300% rise in the search quarter over quarter, amounting to over 270 million views on the topic.

We use both Google and TikTok search data to ensure that we are capturing the activity of multiple generations of consumers. The emerging Gen Z population prefers using social media platforms as a search engine over Google due to the video format, relatability, and personalization of results.

2. Women’s Health

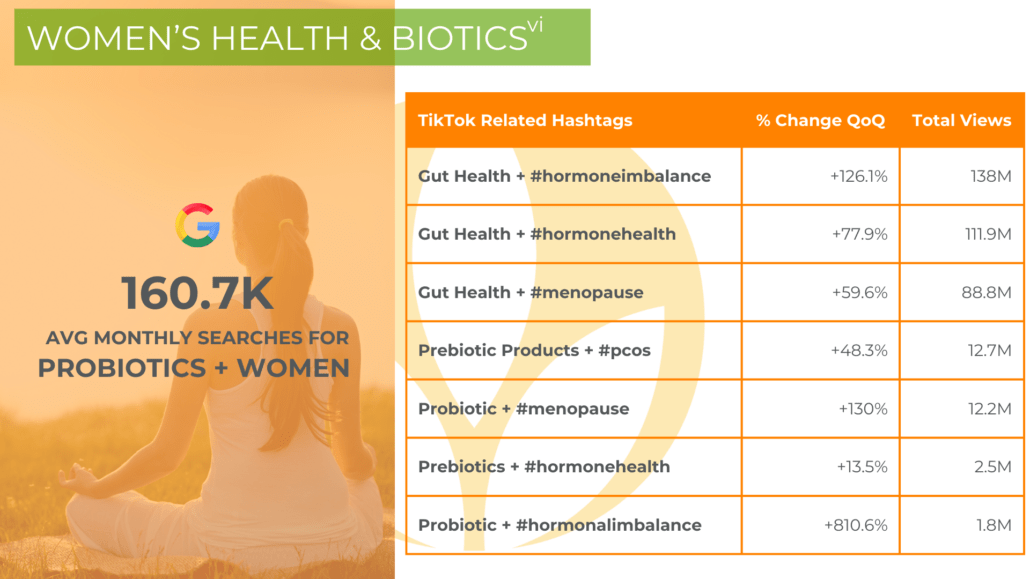

As seen in the Mintel GNPD data, there has been a 161% increase in female-related product claims made on new pre, pro or postbiotic products over the last five years. COMET’s 2024 Trends Report also predicted this rise, as women are increasingly making the connection between gut health and hormonal balance.

Consumer awareness has grown in this area, with Spate reporting almost 500 million consumer hashtag searches and page views of key terms related to the gut microbiome and hormones.

3. Immune Health

Mintel GNPD data shows that there has been a 134% increase in immunity claims used on new products with pre, pro or postbiotics.

The increase in immunity claims has been driven not only by consumers still grappling with uncertainty post-pandemic but also by an increased awareness of the connection between gut health and immunity. FMCG Gurus reports that over the past year, 71% of consumers in North America said they recognize the link between their immune and gastrointestinal health and 74% of global consumers surveyed associate the benefit of improved immune health with a healthy gut microbiome.vii

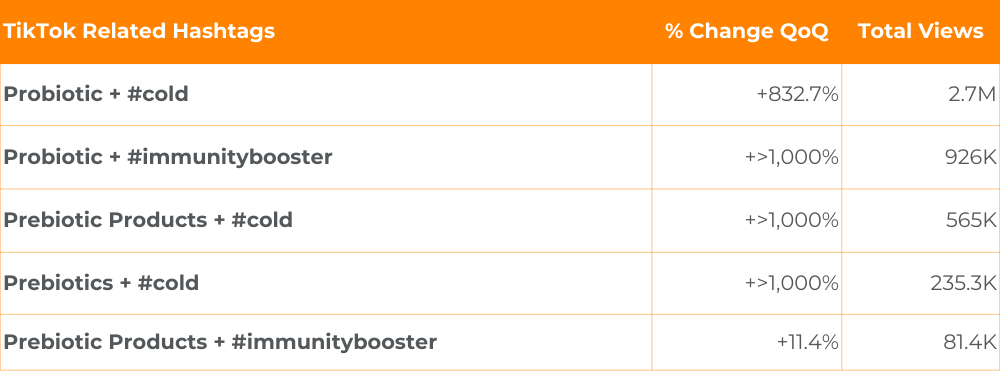

Spate data shows that consumers are actively searching on this subject. “Gut health + immune” as a Google search term is up 239.4% from the same quarter last year and TikTok hashtag searches are rising. See below for top searches amounting to 4.5 million consumer views.

4. Cognition & Mood

Emerging science on the gut-brain axis revolves around the idea that a balanced microbiome and antioxidants may help prevent degenerative brain diseases. This also opens the door to more personalized nutrition.ix Trade publications emphasize that biotics products are good candidates for R&D focused on mental health, including mood, anxiety and potentially even preventative efforts against neurodegenerative diseases like Alzheimer’s, Parkinson’s and Huntington’s disease.x,xi

57% of global consumers say they have looked to improve their mental well-being over the last year.xii Meanwhile, Mintel GNPD reports a remarkable 585% increase in new biotics products carrying a sleep or stress claim and 23% carrying a brain health claim.

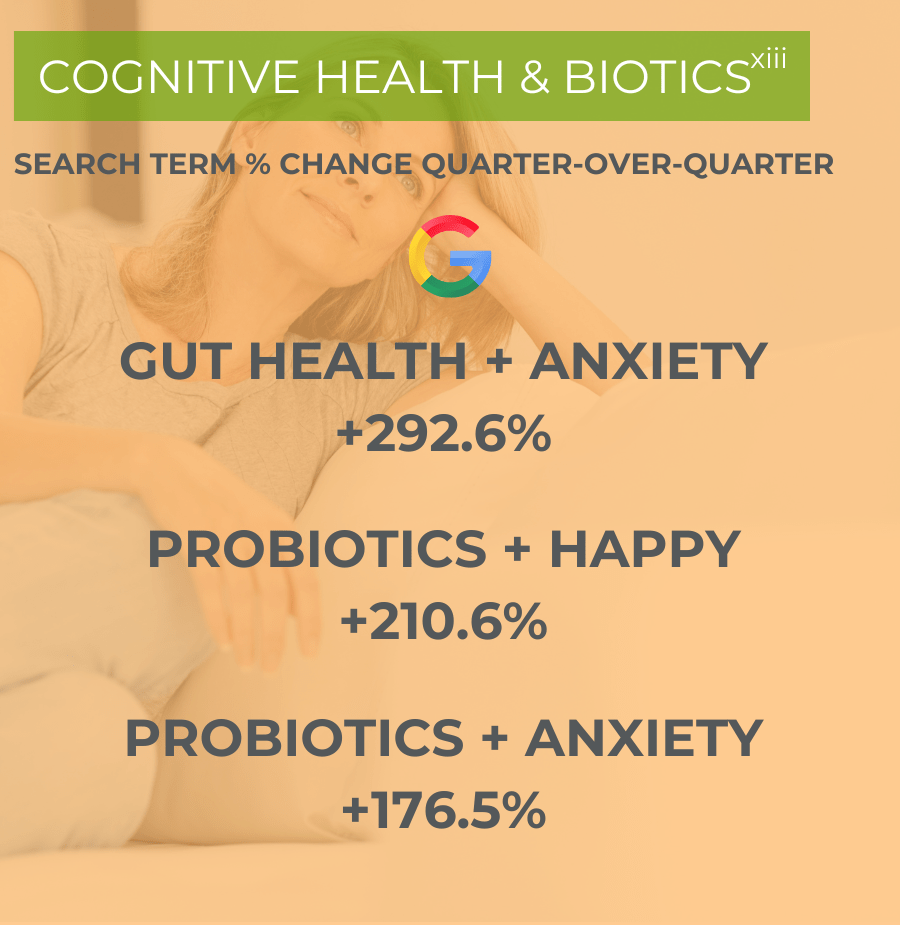

We’re seeing the same patterns on Google search and social media, as consumers zero in on the connection between biotics and brain health with these trends emerging.

#2: EXPLORING MICROBIOMES THAT EXIST OUTSIDE OF THE GUT

WHAT YOU CAN EXPECT: Microbiome health is most associated with the gut, but consumers are discovering how biotics can support other living “biomes” within the body including oral, skin and vaginal.

Innova Market Insights data reports a 52% CAGR rise in microbiome health claims for personal care products from April 2019 to March 2024.xiv Historically, most of these microbiome claims have concentrated on “doing no harm”, meaning that they do not overly sanitize or disrupt the natural balance of good bacteria present.xv Now, however, consumers are looking for biotic products that enhance these essential microbiomes.

1. Oral Microbiome

The oral microbiome is the collection of microorganisms that live in the mouth. It’s the second largest microbial community in the human body, after the gut.

New research indicates that the oral microbiome plays a role in not only dental and periodontal health, but also overall health. Oral health is tied to the immune system and potentially contributes to systemic diseases like cardiovascular disease, diabetes, rheumatoid arthritis, and respiratory issues. An imbalance in oral bacteria (dysbiosis) can lead to inflammation and the spread of bacteria throughout the body through the bloodstream.

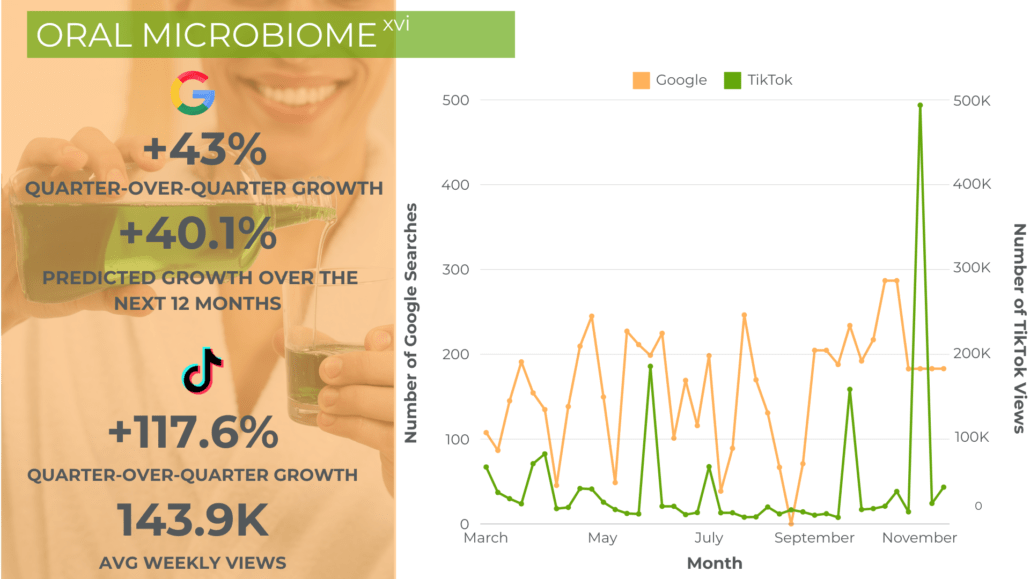

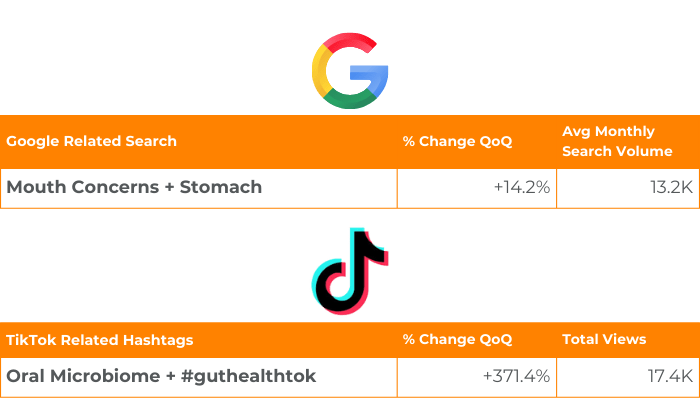

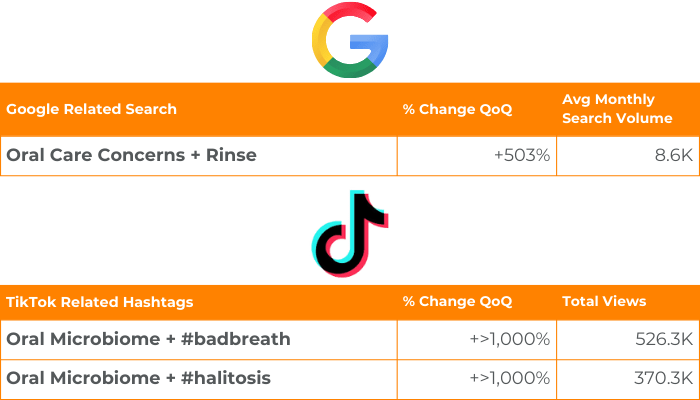

As seen in Google and TikTok data, consumers are becoming increasingly interested in this microbiome and its role in overall health.

While the digestive system is most associated with the gut, it begins with the mouth. Consequently, the oral microbiome impacts the gut microbiome and digestive health in a relationship known as the mouth-gut-axis, a topic consumers are increasingly interested in.

Consumers are now looking for biotic products that support the oral microbiome as Google saw “probiotic toothpaste” rise +129.4% as a search term over the past year.

Lumineux’s first oral care products, the Clean & Fresh line addresses fresh breath, a balanced oral microbiome (with a special focus on reducing the viral load of the mouth) and a deep clean using Dead Sea salt, aloe vera and mint oils.

Twice toothpaste combines cutting-edge science and clean ingredients to create a holistic oral health system that balances your mouth, body and soul.

2. Skin Microbiome (Skinbiotics)

Skin is the largest organ in the body and its microbiome is gaining attention. This bodily surface represents one more way that our body interacts with the outside world, and whereby the complex set of microorganisms that live on the skin’s surface help keep the skin moist, in-tact, and protected from irritants.

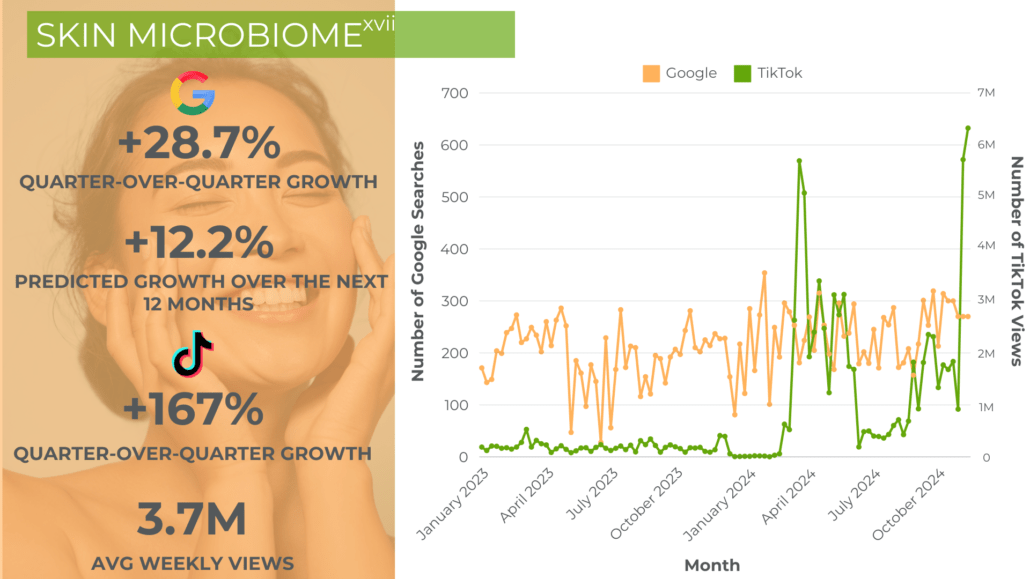

Consumer searches show a rising interest in the skin microbiome, with conversations around “skin microbiome” increasing by 22.3% in one year on Google and 403% in one year on TikTok. Additionally, the search for “skin microbiome” is predicted to grow on Google 12% in the next 12 months.

Weather exposure and the use of some medications or topical treatments can alter the skin microbiome. Experts like the one interviewed in this consumer media article suggest that using biotics in skin care may help keep the balance in favor of healthy skin.

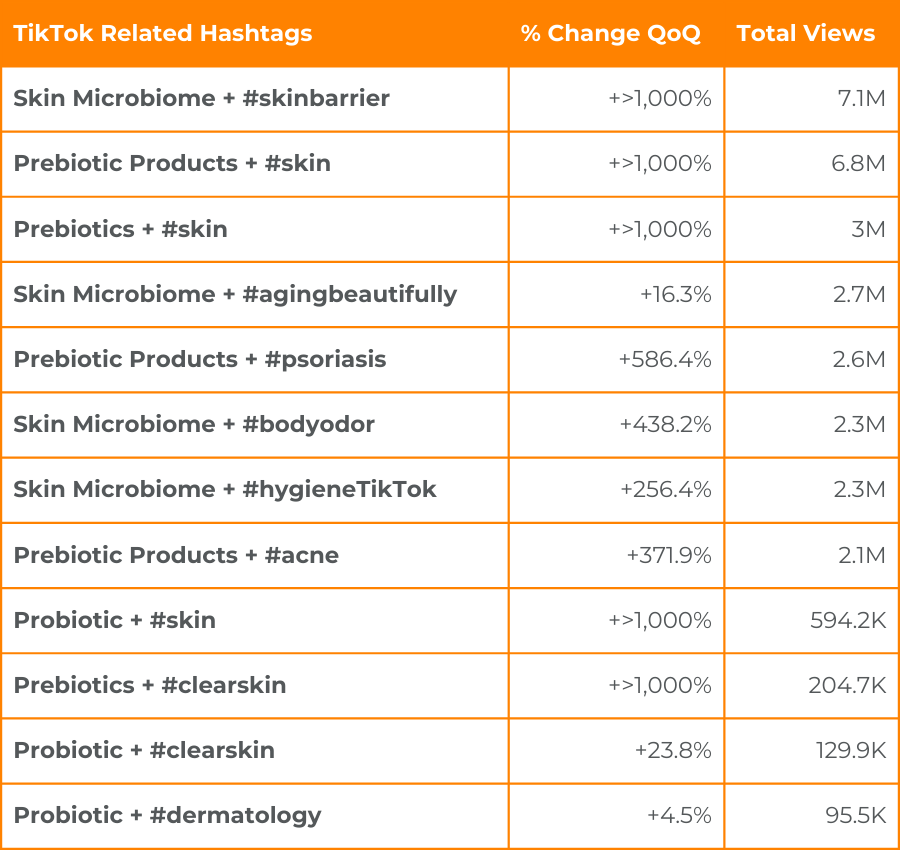

Consumers are taking note as search terms on TikTok have spiked in the latest quarter for biotics linked to skin, including “clear skin”, “skin barrier” and “hygiene”. In fact, Spate trend spotting also showed that on Google, “skin microbiome,” “improve skin microbiome,” “acne skin microbiome” and “how to improve skin microbiome,” were among the top 5 skin microbiome-related search queries by volume in September of this year.

Here’s a snapshot of the dramatic rise in biome-related searches on TikTok with specific biotic key search terms, representing a whopping 29.9 million consumer search views.

DERMA E Pure Biome Skin Care Includes a prebiotic blend to help nourish and calm the skin, promoting a healthy and balanced complexion.

Symbiome claims to restore skin’s natural resilience, health, and beauty through pioneering microbiome science.

3. Female Microbiome

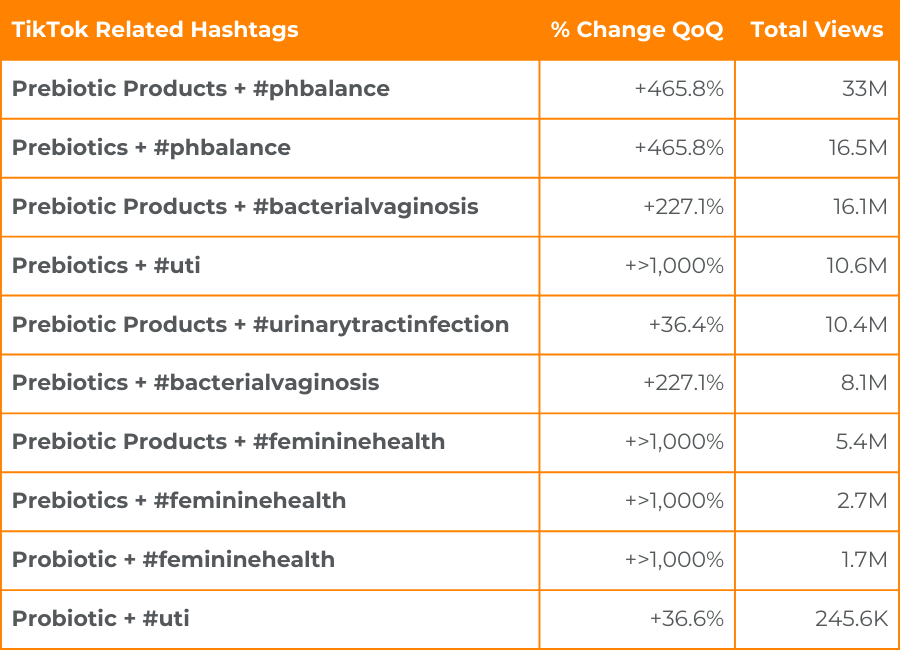

Female needs are important as they affect half the population, but they are not discussed as often as they should be. Consumer search trends signal a boom of interest in how biotic products can support female microbiome needs. Topping the list of TikTok searches for biotics include associations with pH balance and bacterial vaginosis.

Mintel suggests that 48% of US female consumers agree there is a need for better education on women’s health before, during and after major life changes.xviii While this is also a lesser researched area, scientists do see a connection between the consumption of oral supplements, gut health and vaginal health.xix Experts report that since vaginal health is vital for preventing infections and a healthy vaginal microbiome helps maintain overall health, this is a product development opportunity for brands.xx

The table on the right displays additional trending biotics-related hashtags on TikTok that have accrued more than 100 million views.

Product example:

JS Health Vaginal Probiotic+ has been created specifically to support vaginal health, along with gastrointestinal health and general well-being in females. Probiotics Lactobacillus rhamnosus and Lactobacillus reuteri support vaginal healthy flora and vaginal health.

At COMET, we’re always curious to see where the next biotics opportunity may surface, and for certain, we have our eyes on other potential microbiomes like the respiratory tract and the nasal cavity. Perhaps we’ll have news to share in the 2026 Trends Report.

#3: SCIENTIFIC VALIDITY AND PREBIOTIC DIVERSIFICATION

WHAT YOU CAN EXPECT: With rising consumer awareness of biotics comes additional scrutiny. Smart consumers value prebiotic diversity and sound science.

1. “Gut Healthy” Soda Accused of Misleading Claim Usage

This past summer, prebiotics gained national media attention for all the wrong reasons when the “gut healthy” soda brand Poppi was sued for misleading consumers.xxi The lawsuit exposed issues with the most popular prebiotic on the market, inulin, including the high dose needed for claims and consumer-reported GI distress.

This lawsuit invited skepticism of all prebiotic products and put the prebiotic category and its claims under national media scrutiny.

2. Interestingly, two contrasting issues exist right now.

Fairy Dusting: Some companies are making on–pack claims without using the efficacious amount of active ingredients, known as “fairy dusting” (underdosing).

The Outcome: Improper use of structure/function claims only hurt the industry. When a consumer is willing to pay for added benefit, but sees none, they question the repeat trial of that product and may even hesitate to try other products claiming similar benefits.

Overdosing: Many prebiotics break down in certain manufacturing processes, such as the high heat involved in some RTD beverages, baked goods, etc. In this instance, a manufacturer may overdose a prebiotic ingredient, hoping enough will survive the process. (See: Keeping the Fizz in Prebiotic Sodas, Food Dive 2023.)

The Outcome: Overdosing adds costs and calls into question the nutrition label. Many fibers that break down at high heat become monomeric sugars. This calls into question label integrity. Added costs cut into manufacturer margins. Additionally, some prebiotic fibers such as inulin may cause gastrointestinal upset. When greater quantities are intentionally used to offset production losses, consumer acceptance can become an issue.

3. So, what is the solution?

Prebiotic claims on new product launches have jumped 210% in the past five years according to Mintel GNPD data.xxiii While this should be great news for the industry, that growth could be jeopardized if claim integrity isn’t respected. We know from the Poppi lawsuit that marketing ploys and less-than-efficacious products flooding the marketplace can rob consumers of their trust, and the industry of its margins.

As an industry, we can better respond to the educated consumer, who is receptive to science-backed claims and validation certificates like NutraStrong™.

COMET STANDS FOR SCIENTIFIC VALIDITY

COMET's wheat fiber extract, Arrabina® prebiotic fiber, has undergone:

Double-blind crossover randomized control trial before it came to marketxxiv

In-vitro testing with Cryptobiotix to assess efficacy and tolerancexxv

Prebiotic Verified ingredient certification by NutraStrongTM xxvi

What is Inulin?

Inulin is an isolated or single type of fiber commonly derived from chicory root. It can also be found naturally in whole wheat, vegetables, and fruits, such as Jerusalem artichoke. Inulin is considered to be high in FODMAPs, specific oligosaccharide carbohydrates that cause digestive distress in people who are sensitive to them. Functional performance tests indicate that inulin provides digestive prebiotic benefit at 5-grams per serving, however, tolerability of chicory-based fiber can vary with individuals who may be sensitive, such as those with irritable bowel syndrome. For example, one can of Poppi contains about 2 grams of inulin (just around 10% of FDA recommendations), but even in smaller amounts, inulin can cause issues for people with allergies or inflammatory bowel disease.xxvii

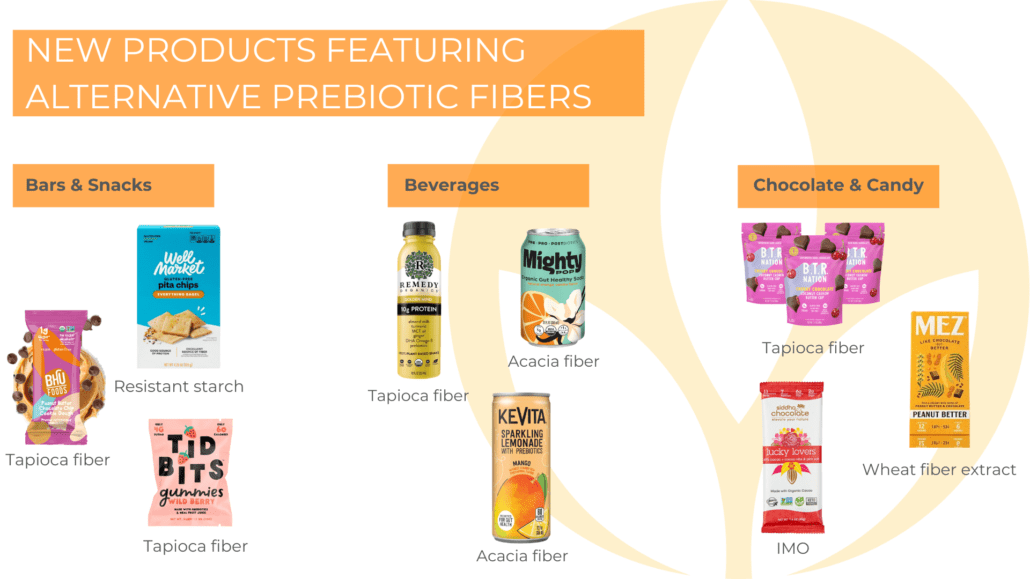

Inulin has long dominated the prebiotic fiber market, but with growing concerns around its tolerance and efficacious dose, giving consumers the option of alternative prebiotic fibers can help gain (or regain) their interest. In general, consumers deserve access to more varied, scientifically proven ingredient options, along with full labeling and transparency about what a product contains, its expected efficacy, and any supporting claims that can help them make an educated choice.

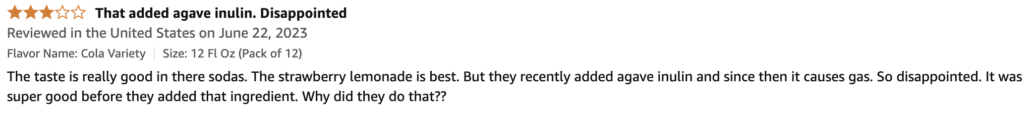

Customer Review, Prebiotic Soda Containing Inulin

Data shows that the industry is responding with inulin-containing products decreasing, and other prebiotics gaining a bigger piece of the pie. According to Mintel GNPD, nutritional drink & other beverage launches containing inulin have decreased by -21.74%, bakery by -11.54%, dairy by -30.77% and frozen desserts/ice cream by -33.33%.

For example, Poppi competitor, Olipop, has released its new Pantry Ready Line of soda using its OLISMART blend of fiber extracts to replace inulin (now including Cassava Root Fiber, Acacia fiber, Guar Fiber, Nopal Cactus, Marshmallow Root, Calendula Flower and Kudzu Root). Olipop claims this line is shelf-stable and still surpasses levels that can impart prebiotic health benefit.

Review of Last Year’s Predictions

Spoiler Alert: COMET’s predictions for 2024 have come to fruition. Check out some highlights from the year that showcase these new areas of opportunity for food, beverages and supplements in the biotics industry.

TREND 1:

SUGGESTED THAT THE GLP-1 DRUG BOOM COULD BE AN OPPORTUNITY FOR PREBIOTIC FIBER SUPPLEMENTATION

What we predicted:

How it’s playing out:

Sales of functional foods tailored to weight management and metabolic health are surging with an estimated $190 billion food and beverage market with GLP-1 users up for grabs.xxix

There are three main ways the COMET team sees brands embracing this trend:

Offer Companion Products

Media reports show that nearly 66% of GLP-1 users are actually eating healthier food choices since starting the medicationxxx, and 83% want GLP-1 support products.xxxi Specifically, products that are nutrient-dense, high fiber (but low in FODMAPs — like Arrabina®, and high protein can help mitigate gastrointestinal upset, fill them up without overeating, and support their gut health, all important elements along the GLP-1 weight management journey.xxxii,xxxiii

Offer an Ozempic Alternative

Creation of products that can support weight management through hormone and appetite-regulating mechanisms similar to GLP-1 drugs are also exploding onto the market.xxxiv Products such as Supergut offer consumers a way to “trigger your body’s hunger-quieting GLP-1 hormone naturally” given its prebiotic content. Supergut sales have more than tripled over the past year, demonstrating that consumer interest in these more natural alternatives is high.xxxv

Offer Maintenance Support

It has been shown that weight gain is expected among individuals who discontinue use of GLP-1 medications, with individuals regaining two-thirds of their weight loss within one year.xxxvi

Knowing this, individuals coming off the drugs are highly motivated to maintain the weight loss and are willing to invest in products that might help. Sales of products that have some ability to mimic the GLP-1 effect naturally are expected to surge in the years ahead, with many products already on shelf, including ResBiotic Prebeet, SoWell GLP-1 Support System and Lemme GLP-1 Daily™ Capsules.

New Product Launches

Lemme GLP-1 Daily claims to support your body’s GLP-1 hormone, reduces hunger, promotes healthy insulin function and supports healthy weight management with 3 clinically-tested ingredients.

SoWell The GLP-1 Support System: Maximize results and minimize GLP-1 side effects with this easy doctor-developed system.

Resbiotic Prebeet is a powdered drink mix that naturally boosts GLP-1.

TREND 2:

SUGGESTED GEN-ZERS NEED FULL TRANSPARENCY

What we predicted:

If brands are not clued into Gen Zers yet, they should be, as this group will surpass Millennials as the largest consumer base in the U.S. by 2026. How do biotics deliver on Gen Zers‘ needs? This group seeks a holistic wellness style and a transparent approach – preferably through social platforms and people they can trust. Read more about how to reach this unique set of individuals.

How it’s playing out:

Gen Zers, who will be 13 to 25 years old in 2025, continue to view social media as more than a way to connect with friends and loved ones, but as an educational and product discovery tool. In fact, Instagram and TikTok are now the preferred search engines for Gen Zers. According to a new study of 1,002 U.S. consumers, Instagram is Gen Zer’s first choice, with 67% saying they use Instagram to search, TikTok is the second choice with 62%, and Google is third at 61%.xxxvii

Biotic brands are responding by joining the conversation on social media platforms, including TikTok’s popular #guttok and including social media claims on pack. In fact, social media claims for new products with prebiotics went up +13.48% over five years and those containing prebiotics, probiotics or postbiotics went up +8.53%.xxxviii

Noteworthy products seen this year include BelliWelli probiotic snacks, Bloom prebiotic-infused, sparkling energy drink and SunSip Soda With Benefits. As probiotic product manufacturer Nutiani recaps, “With over six billion views for gut health content under key hashtags #GutHealth and #GutTok on the Gen Z-dominated app TikTok, it is becoming increasingly clear that the generation born between 1997 and 2012xxxix is the up-and-coming consumer group for nutrition brands focusing on digestive health solutions.”

@belliwellihealth Not sugar coating this…#belliwelli #fiber #collagen #probiotics #trendy ♬ original sound - BelliWelli

TREND 3:

SUGGESTED AN OPPORTUNITY FOR BIOTICS TO FOCUS ON WOMEN’S HEALTH

What we predicted:

This trend essentially said that women know what they need and are no longer afraid to talk about it. Women have unique needs through their many ages and stages in life, including menstrual and vaginal health, conception, pregnancy, menopause and more needs that shift on a monthly or mid-monthly basis. Focus on the microbiome with biotic-enhanced foods, beverages and supplements can appeal specifically to women’s needs.

How it’s playing out:

According to Innova’s Health and Nutrition Survey in 2024, almost 2 in 5 female respondents say they use vitamins/mineral supplements related to their hormone cycles,xl and this is reflected in the industry as new products containing probiotics, prebiotics or postbiotics for women are up +161.06%xxiii and those for maternal health are up +34.92%.

New Product Launches

Uro Vaginal Probiotic Capsules target issues at the core, to support healthy vaginal pH, vaginal odor, yeast balance and vaginal flora.

Bond Cycle Care provides an all-in-one supplement designed for women wanting a root-cause approach to naturally supporting a regular menstrual cycle and premenstrual syndrome.

Arrae Tribiotic provides all-in-one support for gut, vaginal, skin, and immune health with clinically studied pre, pro, and postbiotics.

TREND 4:

SUGGESTED SHOWING VALUE IN MEANINGFUL WAYS

What we predicted:

With inflation continuing to climb, cost-effective products that deliver multiple synergistic benefits, whether actual or perceived, are the name of the game in this trend.

How it’s playing out:

Among the top drivers of value for consumers are claims of “added health benefits,” with one-third of snack consumers increasing their consumption of snacks featuring these claims.xli At the same time, interest in “sustainable food & beverages” has grown by 18.4% over the past two yearsxlii, while 55% of consumers indicate they are willing to pay a premium for brands with “eco-friendly” claims.xliii

Over the past five years,xliv products featuring probiotics, prebiotics, or postbiotics with sustainability claims have significantly increased. Notable examples include a 286.81% rise in “carbon neutral” claims, a 91.22% growth in “ethical – environmentally friendly” claims, and a 37.10% increase in “ethical – sustainable habitat” claims. See here for examples of products embracing these trends.

New Product Launches

Mez Foods mesquite-based chocolate alternative with amazing flavor, nutrition profile, and sustainability potential.

Earth’s Creation offers a diverse range of supplements including nutrients sourced directly from premium superfoods and specialized blends for overall health, gut health, memory and focus, and stress relief.

Orgain Wonder Gut daily 5-in-1 gut health powder mix brings together hand-picked ingredients for maximum microbiome support.

Methodology

To create this report, we utilized social listening and market data along with our expert analysis to identify key trends driving the biotics industry.

Mintel GNPD monitors worldwide product innovation and new product activity in consumer-packaged goods markets. It covers overs food, drink, household, beauty & personal care, healthcare, and pet sectors across key global markets. The tool analyzes 270 subcategories, 140 product claims, 200 packaging attributes, and over 46,000 ingredients.

Spate is an innovative data platform that allows users to discover and detect trends across Google search and TikTok. The Spate dashboard analyzes over 20 billion search signals and over 60 million TikTok videos across the globe to answer three crucial questions for the consumer goods industry. What’s the next big trend? Who’s owning the space? How to position the trend?

About the authors

As a Registered Dietitian and VP of Marketing & Nutrition Affairs, Hannah Ackermann uses her expertise to drive COMET’s nutrition strategy and educate customers. Hannah oversees COMET’S marketing and communications, including providing insights on market research and consumer trends.

Before joining COMET, Hannah worked in nutrition marketing at leading global market research and public relations firms. Hannah holds bachelor’s degrees in Nutritional Science and Journalism, and a Master of Business Administration in Marketing.

Marketing Specialist at COMET, Taylor Davis, leverages her understanding of industry & consumer trends to inform and execute impactful strategies. Taylor manages COMET’s digital presence and marketing materials, helping position the company as a leader in the biotics market.

Taylor is a Purdue University Daniels School of Business graduate and has been part of the COMET family for nearly three years.

Wendy Weiss is a Registered Dietitian with a career history in nutrition and health communications, supporting COMET in development of public relations programming, content and project execution. Wendy strives to create science-based content and professional materials and was selected as a co-author of the novel textbook “The Academy of Nutrition and Dietetics Guide to Nutrition Communications” Academy of Nutrition and Dietetics, published in 2020.

About COMET

COMET is an award-winning food ingredients company based in London, Ontario, and Schaumburg, Illinois. COMET is the only company with the IP and expertise needed to create Arrabina®, an FDA-recognized fiber with superior tolerance in the gut even at 4 or more servings daily and clinically proven prebiotic health benefits. Arrabina® is gluten-free wheat fiber extract containing a natural blend of prebiotics including arabinoxylans, lignin and polyphenols. COMET’s proprietary line of Arrabina® dietary fibers are upcycled certified and can easily be added to any food and beverage application.

[i] DSM Global Health Concerns Study. 2023.

[ii] Search: Mintel. Global New Products Database. North America, launches with prebiotic, probiotic, postbiotic ingredients. Sept 2019 to Sept 2024.

[iii] Kassim G, et al. S3207 Time Trends in Gut Microbiome Clinical Trials in Gastroenterology. Am J Gastroent. 2020;115(1), S1681–S1682. https://doi.org/10.14309/01.ajg.0000714876.58106.c0

[iv] Eastlake D. Good news for gut health industry as bad gut bacteria linked to obesity. Food Navigator. Sept 26, 2024.

[v] Spate. US Search from Nov 2023 to Oct 2024 vs Nov 2022 to Oct 2023; US TikTok week of Nov 17, 2024 vs week of Nov 10, 2024.

[vi] Spate. US Search from Nov 2023 to Oct 2024; US TikTok from Aug 25, 2024 to Nov 17, 2024 vs Jun 2, 2024 to Aug 25, 2024.

[vii] Future Trends, Life in 2030 Global Report. FMCG Gurus. Feb 2023.

[viii] Spate. US TikTok from Aug 25, 2024 to Nov 17, 2024 vs Jun 2, 2024 to Aug 25, 2024.

[ix] Richards L. Oxidative stress and gut microbiota. NutraIngredients. Oct 1, 2024.

[x] Nikolova M. Emerging ingredients in mental health. Nutrition Insights. Oct 8, 2024.

[xi] Mellentin J. Key trends in functional foods for 2025. Nutraceuticals World. Oct 7, 2024.

[xii] Top 10 Trends for 2024. FMCG Gurus. Oct. 2023.

[xiii] Spate. US Search from Aug 2024 to Oct 2024 vs May 2024 to Jul 2024.

[xiv] Innova Market Insights. Search: personal care products, microbiome health. Apr 2019 to Mar 2024.

[xv] Millennials wary disinfectants destroy ‘good’ bacteria. Mintel. Aug 3, 2017.

[xvi] Spate. US Search from Feb 2024 to Nov 2024; US TikTok ending Nov 24, 2024.

[xvii] Spate. US Search from Jan 2023 to Nov 2024 vs Jan 2022 to Nov 2023; US TikTok ending Nov 17, 2024.

[xviii] Women’s Wellness. Mintel Reports. 2024.

[xix] What happens in the gut can have an impact on the vaginal microbiota. Now scientists understand why. Gut Microbiota for Health. 2023.

[xx] Lim Y. Nutrition Watch: Vaginal Health. Mintel. Jan 24, 2024.

[xxi] Poppi Class Action Lawsuit. Kristin Cobbs v. Vngr Beverage LLC, Case No. 3:24-cv-03229-AGT. Filed May 29, 2024.

[xxii] Bendix A. A lawsuit challenges Poppi soda’s claims of boosting gut health. Scientists say the drink doesn’t offer much benefit. NBC News. Jun 11, 2024.

[xxiii] Search: Mintel GNPD, new products, probiotics, prebiotics or postbiotics, North America, 2019 to 2024.

[xxiv] Chen O, et al. The Effect of Arabinoxylan on Gastrointestinal Tolerance in Generally Healthy Adults: A Randomized, Placebo-Controlled, Crossover Study. Curr Dev Nutr 2021;5(Supplement_2), 304–304. https://doi.org/10.1093/cdn/nzab037_014

[xxv] Ex vivo model of intestinal fermentation, Cryptobiotix study, Data on file. 2024.

[xxvi] Press Release. Arrabina® Gains NutraStrong™ Prebiotic Verified Product Certification. Nov 12, 2024.

[xxvii] Is Poppi good for you? Dietitians break down the pros and cons of prebiotic sodas. Today.com. Jun 13, 2024.

[xxviii] Search: Mintel GNPD, Prebiotic Ingredients Ingredient % change, North America 2023 to 2024.

[xxix] Getting to know GLP-1 users, a new kind of consumer. KPMG. 2024

[xxx] Ozempic and UPF Survey. Innova. 2024.

[xxxi] ADM: 83% of GLP-1 users are ‘very interested in products specifically marketed as supportive of their needs on these drugs‘ Food Navigator. Oct 9, 2024.

[xxxii] Shetty R, et al. Adverse drug reactions of GLP-1 agonists: A systematic review of case reports. Diabetes Metab Syndr. 2022; 16(3). https://doi.org/10.1016/j.dsx.2022.102427

[xxxiii] Wilding P, et al. Once-Weekly Semaglutide in Adults with Overweight or Obesity. N Engl J Med. 2021;384 (11):989-1002. DOI: 10.1056/NEJMoa2032183

[xxxiv] Supplements Companies are Cashing in on the Ozempic Wave. Wired.com. Aug 14, 2024.

[xxxv] Supergut shines in Ozempic era: ‘We’ve tripled the business over the past 5-6 months’. AgFunderNews. Mar 25, 2024.

[xxxvi] Wilding J, et al. Weight regain and cardiometabolic effects after withdrawal of semaglutide: The STEP 1 trial extension. Diabetes Obes Metab. 2022(24) 8:1553-1564.

[xxxvii] GenZ Dumping Google for TikTok, Instagram as Social Search Wins. Forbes. Mar 11, 2024.

[xxxviii] Search: Mintel GNPD Social media claim, new products, prebiotics, all regions. Sept 2019 to Sept 2024.

[xxxix] Age Range by Generation. Beresford Research. 2024.

[xl] Health and Nutrition Survey. Innova. 2024.

[xli] Healthy Snack Trends in the US. Innova. 2023.

[xlii] Flavor Chase: 2025’s Most Disruptive Food & Beverage Trends. Tastewise. 2024.

[xliii] Bounfantino G. New Research Shows Consumers More Interested in Brands’ Values than Ever. Consumer Goods Technology. Apr 27, 2022.

[xliv] Mintel GNPD. Searches: new products, probiotics, prebiotics or postbiotics, all regions, 2019 to 2024, and carbon neutral, ethical – environmentally friendly, ethical – sustainable habitat/resources, vitamins & dietary supplements.