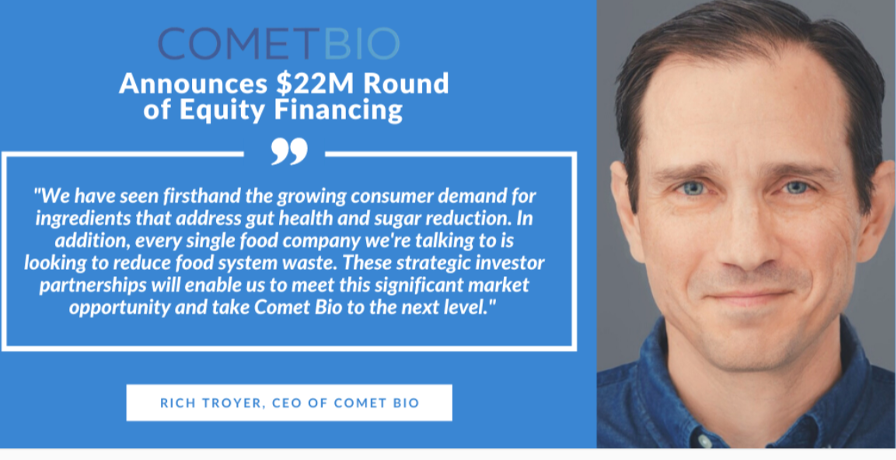

LONDON, ON, July 13, 2021 /PRNewswire/ — Comet Bio, manufacturer of healthy, sustainable, and award-winning ingredients, announced today the completion of the company’s Series C with an initial close of $22M. The round was led by Open Prairie, a multi-faceted private equity fund management firm with headquarters in Effingham, Illinois. Other investors include Louis Dreyfus Company (LDC), BDC Capital, and existing investor Sofinnova Partners.

“Thanks to the support of our exceptional investors, we will now be able to invest in a dedicated manufacturing facility to grow the supply of our upcycled ingredients,” said Rich Troyer, CEO of Comet Bio. “We will also be investing in innovation including our product pipeline and health claims development.”

Comet Bio, headquartered in London, Ontario, and Schaumburg, Illinois, uses its patented upcycling technology to produce innovative ingredients. Its Arrabina Arabinoxylan Plant Fiber Extract is a premium prebiotic dietary fiber with superior tolerability and functionality. It’s clinically proven to promote growth of beneficial bacteria in the gut, help maintain healthy blood glucose levels, and support immunity. The company’s line of Sweeterra syrups is a sustainable and lower sugar alternative to traditional sweeteners with no trade-offs in taste and performance.

“According to Global Market Insights, the prebiotic category is valued at close to $6B and is expected to exceed 10% CAGR in coming years,” said Troyer. “We have seen firsthand the growing consumer demand for ingredients that address gut health and sugar reduction. In addition, every single food company we’re talking to is looking to reduce food system waste. These strategic investor partnerships will enable us to meet this significant market opportunity and take Comet Bio to the next level.”

“Open Prairie is excited to leverage its team expertise and network to advance commercialization of Comet Bio’s ingredient technology platform and to facilitate diversification of US-focused distribution channels that benefit the Open Prairie Rural Opportunities Fund’s investment objective of catalyzing growth for agriculture and rural America,” said Tom Doxsie, a partner in the firm.

“We see tremendous potential for nutritious ingredients from upcycled agricultural materials and believe Comet Bio is well-positioned to capture this opportunity,” said Max Clegg, Head of LDC Innovations.

“We are excited to support an innovative Canadian AgTech company to accelerate the commercialization of its novel upcycling technology to convert agricultural waste into healthy and sustainable food ingredients,” said Matt Stanley, Director, BDC Capital’s Cleantech Practice.

“Since its inception, we have been impressed by Comet Bio’s ability to identify and produce unique, sustainable ingredients in high demand and look forward to continue supporting the management team as they accelerate commercialization,” Joško Bobanović, Partner at Sofinnova Partners.

To learn more about Comet Bio, its proprietary technology, and its award-winning ingredients, visit https://comet-bio.com/.

About Comet Bio

Comet Bio is an award-winning food technology company based in London, Ontario, and Schaumburg, Illinois. The company makes unique, healthy, and sustainable products using its patented upcycling technology. Its Arrabina Arabinoxylan Plant Fiber Extract is a premium prebiotic dietary fiber with superior tolerability and functionality. For more information, visit https://comet-bio.com/ and follow us on Twitter at @cometbio.

About Open Prairie

Open Prairie, based in the heartland of America with headquarters in Effingham, Illinois, is a multi-faceted private equity fund management firm with deep roots in rural America. For more than twenty years, Open Prairie has consistently focused on facilitating capital accessibility in underserved markets. The Open Prairie team has managed funds ranging from technology-based venture capital to farmland portfolios. Through its expertise across all functional business disciplines and an extensive network of professionals, Open Prairie works in partnership with its portfolio companies to accelerate growth while providing top tier returns to its investors. For more information about Open Prairie, please visit www.openprairie.com.

About BDC Capital

BDC Capital is the investment arm of BDC, the bank for Canadian entrepreneurs. With over $3 billion under management, BDC Capital serves as a strategic partner to the country’s most innovative firms. It offers businesses a full spectrum of capital, from seed investments to growth equity, supporting Canadian entrepreneurs who have the ambition to stand out on the world stage. Visit bdc.ca/capital.

About Louis Dreyfus Company

Louis Dreyfus Company (LDC) is a leading merchant and processor of agricultural goods. The company leverages its global reach and extensive asset network to serve customers and consumers around the world, delivering the right products to the right location, at the right time – safely, reliably and responsibly. LDC’s activities span the entire value chain from farm to fork, across a broad range of business lines (platforms). Since 1851 its portfolio has grown to include Grains & Oilseeds, Coffee, Cotton, Juice, Rice, Sugar, Freight and Global Markets. LDC helps feed and clothe some 500 million people every year by originating, processing and transporting approximately 80 million tons of products. Structured as a matrix organization of six geographical regions and eight platforms, LDC is active in over 100 countries and employs approximately 17,000 people globally. For more information, please visit www.ldc.com.

About Sofinnova Partners

Sofinnova Partners is a leading European venture capital firm in life sciences, specializing in healthcare and sustainability. Based in Paris, London and Milan, the firm brings together a team of professionals from all over the world with strong scientific, medical and business expertise. Sofinnova Partners is a hands-on company builder across the entire value chain of life sciences investments, from seed to later-stage. The firm actively partners with ambitious entrepreneurs as a lead or cornerstone investor to develop transformative innovations that have the potential to positively impact our collective future. Founded in 1972, Sofinnova Partners is a deeply-established venture capital firm in Europe, with 50 years of experience backing over 500 companies and creating market leaders around the globe. Today, Sofinnova Partners has over €2 billion under management. For more information, please visit: www.sofinnovapartners.com